Existing Players Expanding. New Players Entering.

Libya has completed its first upstream bid round in 17 years, awarding acreage across the Sirte and Murzuq basins and formally reopening its licensing cycle. The awards went to a mix of returning majors, established operators and first-time entrants.

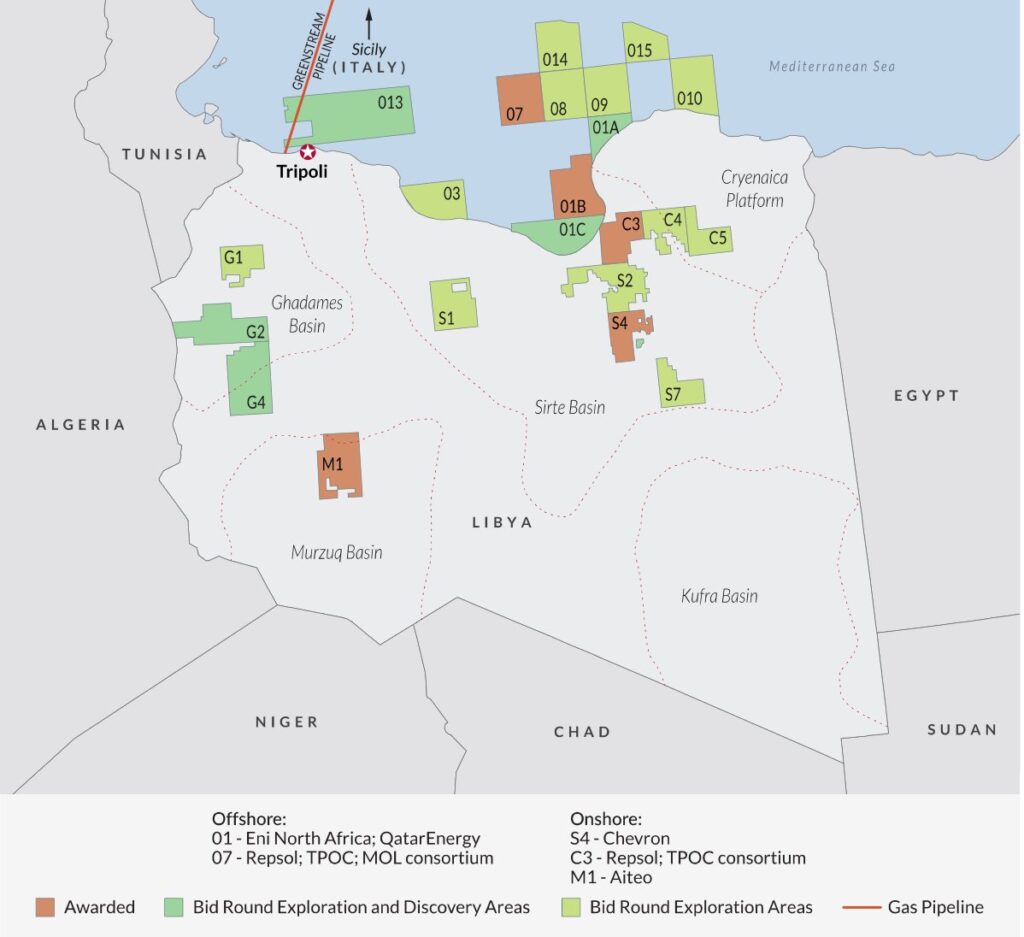

Onshore, Chevron marked its return to Libya after operating in the country prior to 2011, securing Block S4 in the Sirte Basin. Nigerian independent Aiteo entered Libya through Block M1 in the Murzuq Basin, its first asset outside Nigeria. Repsol and Turkish Petroleum Corporation (TPAO) also secured onshore acreage in the Sirte Basin, expanding Repsol’s existing position in the country.

Offshore, Eni and QatarEnergy were awarded Block 01 in the Sirte Basin, strengthening Eni’s long-standing presence in Libya. A consortium of Repsol, TPAO and MOL Group secured Block 07, marking MOL’s entry into Libya’s upstream sector and Repsol’s first offshore position in the country.

With a subsequent round already signalled, attention now turns from allocation to implementation.

A Setback or Comeback for Libya Oil?

Libya’s bid round delivered fewer awards than expected, with five blocks allocated from 20 on offer despite strong pre-qualification interest. The limited follow-through reflects elevated costs, lower oil prices and demanding minimum work commitments. For many companies, the commercial upside did not sufficiently offset perceived operational and fiscal risk.

However, the outcome should not be measured solely by the award count. Several companies have instead favoured MoUs and direct negotiations, preserving optionality through phased technical evaluation rather than committing via competitive bids. In this context, agreements may materialise outside the formal round. The recent multi-billion-dollar agreement between ConocoPhillips and TotalEnergies to extend the Waha licences illustrates how capital deployment can advance through negotiated frameworks rather than competitive awards.

Investor sentiment remains measured. Companies are allocating capital selectively, benchmarking Libya against more predictable markets. Announcements alone will not shift that stance — visible execution will.

The next phase therefore hinges on implementation: turning awards and agreements into operational activity on the ground.

From Award to Execution

With awards confirmed, attention shifts from licensing to delivery. Production Sharing Agreements (PSAs) are being finalised, formalising operator rights, fiscal terms and investment obligations.

Once concluded, mobilisation begins — defining survey programmes, agreeing contractor scopes, structuring logistics and preparing technical teams for deployment. At this stage, timelines depend less on contractual closure and more on operational readiness.

Field mobilisation in Libya requires aligned progress across transport access, regulatory approvals, security planning, workforce entry and remote-site infrastructure. In the Murzuq Basin, infrastructure and logistics corridors require verification and contingency planning. In the Sirte Basin, conditions are more developed but still demand continuous reassessment. Delays are often attributed to “country risk,” yet they frequently stem from fragmented execution.

Early delivery matters. Investors will judge progress not by contract announcements, but by activity on the ground. The speed at which awarded blocks move into surveys, site preparation and operational deployment will shape perceptions of Libya’s reliability as an investment destination.

Managing Execution Risk

For operators entering or expanding in Libya, the challenge extends beyond subsurface uncertainty. Execution risk often determines whether early progress is sustained. Effective delivery requires integrated oversight that aligns security, transport, regulatory processing and personnel deployment within a single operational structure. When these elements move together, operations remain structured rather than reactive.

At EC, our involvement begins at this transition point between award and field activity. Through integrated Operational, Business and Life Support services, we align ground logistics, regulatory coordination, and security management into a unified execution structure. By managing these streams under shared timelines and continuous in-country oversight, operators gain confidence in execution and delivery.